3 Tips for Lowering Your Renters Insurance

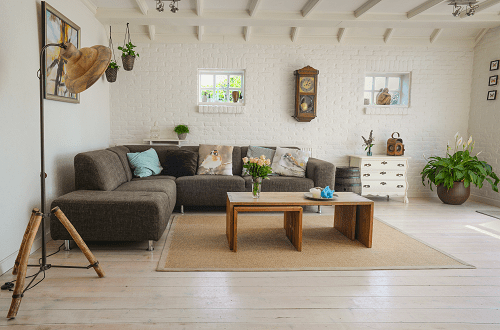

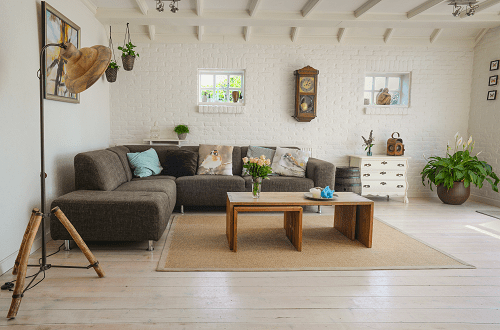

For what you pay, renters insurance offers great value. Twenty to thirty dollars per month can cover everything you own inside of your apartment, whether it’s clothing, sports gear, computers, electronics or furniture. If your possessions are damaged or stolen, you don’t have to suffer the loss of thousands of dollars. But even with rates as low as they are, you can lower them further by using the following tips.

Where You Rent Affects Your Rates

If you’re in the process of finding an apartment, choose a place that is low risk. This means choosing a low crime neighborhood and a well maintained, modern apartment building. Look at the apartment through the eyes of a safety inspector. Do you see fire extinguishers in the halls? Are there smoke alarms and heat sensors installed? Do the doors and windows have strong secure locks? Is the entrance door to the building securely locked? Insurance companies protect themselves by charging higher premiums for high risk situations. By choosing safer apartments, your insurance is likely to cost less.

A Higher Deductible Means a Lower Premium

When you make an insurance claim, the deductible is the amount of money you pay up front before the insurance company pays the rest. For example, a claim of $5,000 with a deductible of $500 means that you must pay the first $500 before the insurance company pays the remainder of $4,500. Deductibles allow you to assume different levels of risk. The more risk you assume, the less risk the insurer has to assume, which means you pay a smaller premium.

Get Both Renters and Auto Insurance From a Single Company

Often insurance companies will give discounts when you buy more than one line of insurance from them. If you’ve used the company for several years for your auto insurance, you may also get a discount for customer loyalty.

With a discount on insurance rates that are low to begin with, there really is no reason for not protecting your possessions with renters insurance. Your agent can help you get started.

Start saving today. Call Hanway Insurance at (708) 874-6000 for more information on renters insurance.

Categories: Blog